12.0 INTRODUCTION

Public finance is the study of how governments raise and spend money, encompassing revenue generation (like taxation), expenditure management, and the overall impact of government financial policies on the economy and society.

12.0 FISCAL POLICY

Fiscal policy refers to the use of government spending and taxation to influence the economy.

OBJECTIVES OF FISCAL POLICY

- Stabilize the economy.

- Promote economic growth.

- Reduce unemployment.

- Control inflation.

TOOLS OF FISCAL POLICY

- Government spending (infrastructure, education, health)

- Taxation (income tax, corporate tax, sales tax)

TYPES OF FISCAL POLICY

- Expansionary Fiscal Policy: Increases in government spending and/or decreases in taxes to stimulate the economy.

- Contractionary Fiscal Policy: Decreases in government spending and/or increases in taxes to cool down an overheated economy.

12.2 TAXATION

Taxation is the process by which a government collects money from individuals and businesses to fund public services.

CLASSIFICATION OF TAX

- Direct Taxes: Taxes that are paid directly by individuals or organizations to the government. Examples include Income Tax, Corporate Tax, Property Tax.

- Indirect Taxes: Taxes that are levied on goods and services and are paid indirectly by consumers. Examples include Value Added Tax (VAT), Sales Tax, Excise Duty.

CLASSIFICATION OF TAX (Based On Tax Structure)

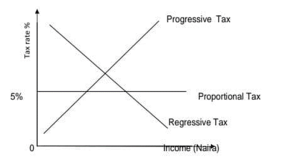

- Progressive Tax: The tax rate increases as the taxable amount increases. Higher income earners pay a larger percentage of their income in taxes. Example: Income tax in many countries.

- Regressive Tax: The tax rate decreases as the taxable amount increases. Lower income earners pay a larger percentage of their income in taxes. Example: Sales tax.

- Proportional Tax: A flat tax rate is applied to all income levels, meaning everyone pays the same percentage. Example: Some corporate taxes.

DIAGRAM SHOWING PROGRESSIVE, REGRESSIVE AND PROPORTIONAL TAX

12.3 PRINCIPLES OF TAXATION

- Equity: Taxes should be fair and just.

- Efficiency: Taxes should not create significant economic distortions.

- Certainty: Taxpayers should know how much tax they owe and when to pay it.

- Convenience: The tax payment should be easy for the taxpayer.

12.4 BUDGET

A budget is a financial plan that outlines expected revenues and expenditures for a specific period.

TYPES OF BUDGETS

- Surplus Budget: When expected revenues exceed expenditures.

- Deficit Budget: When expenditures exceed expected revenues.

- Balanced Budget: When revenues equal expenditures.

IMPORTANCE OF BUDGETS

- Helps in resource allocation.

- Provides a framework for economic policy.

- Facilitates accountability and transparency in government spending.

12.5 PUBLIC DEBT

Public debt is the total amount of money that a government owes to creditors.

TYPES OF PUBLIC DEBT

- Domestic Debt: Borrowing from local lenders.

- Foreign Debt: Borrowing from foreign lenders.

IMPLICATIONS OF PUBLIC DEBT

- Can finance public projects and stimulate economic growth.

- High levels of debt can lead to financial instability and affect credit ratings.

- Management: Governments must manage public debt carefully to ensure it remains sustainable.

12.6 TAX OF INCIDENCE

Tax incidence refers to the analysis of the effect of a particular tax on the distribution of economic welfare. It examines who ultimately bears the burden of a tax, which may differ from the entity that is legally responsible for paying the tax.

TYPES OF TAX INCIDENCE

- Formal Incidence: Refers to the legal obligation to pay the tax. For example, if a tax is levied on producers, they are legally responsible for paying it to the government.

- Effective Incidence: Refers to the actual burden of the tax, which may differ from the statutory incidence. It considers how the tax affects prices and income distribution.

FACTORS INFLUENCING TAX INCIDENCE

- Elasticity of Demand: if demand is inelastic (consumers are less responsive to price changes), consumers will bear a larger share of the tax burden.

- Elasticity of Supply: If supply is inelastic (producers cannot easily change production levels), producers will bear a larger share of the tax burden.

- Market Structure: In competitive markets, the burden of tax is more likely to be shared between consumers and producers. In monopolistic markets, producers may pass a larger portion of the tax onto consumers.

- Nature of the Tax: Direct taxes (like income tax) are typically borne by the individual or entity that pays them. Indirect taxes (like sales tax) can be passed on to consumers through higher prices.

ELASTICITY OF TAX: Elasticity of Tax refers to the responsiveness of tax revenue to changes in the tax base, such as income, consumption, or production levels. It measures how much tax revenue changes when there is a change in the economic activity that the tax is based on.

DTW Tutorials Study Resource Links;

First of All to obtain high JAMB &WAEC Scores, YOU HAVE TO Practice! Practice!! Practice!!

Use DTW JAMB & WAEC 2025 CBT Practice App!!!

– GET DTW TUTORIALS JAMB & WAEC 2025 CBT EXAM PRACTICE APP for all Subjects with over 31,000 Past Questions and Correct Solutions to Practice with offline! (Activation cost is N4000 for 1 year) Download Links Below for Mobile Phones & Laptop Computer;

DTW TUTORIALS JAMB 2025 APP For MOBILE Phone Direct Download link;

https://play.google.com/store/apps/details?id=com.iafsawii.dtw.jamb

DTW TUTORIALS JAMB 2025 APP For DESKTOP Laptop Computer Direct Download link; https://drive.google.com/file/d/1iIHBoWjEeJeCFyTO9nt-9kAveH2FqjrT/view?usp=sharing

Download Links for WAEC 2025 App;

JAMB RESOURCE LINKS BELOW;

– JAMB Past Questions Solved Playlists on Math, Phy, Chem; https://www.youtube.com/playlist?list=PLLgYU6fS5143-p4dfWIFL7keuB1SBgT2b

– THE LEKKI HEADMASTER – Summary, Questions And Answers (JAMB 2025 NOVEL); https://dtwtutorials.com/the-lekki-headmaster-jamb-2025-novel-summary-questions-and-answers-pdf-download/

– JAMB 2025 Recommended Text Books – https://dtwtutorials.com/jamb-2025-recommended-text-books-for-all-subjects/

– JAMB 2025 Syllabus all Subjects – https://dtwtutorials.com/jamb-2025-syllabus-free-download/

– JAMB 2025 Syllabus in 30 Days Timetable Challenge by DTW Tutorials for Science, Art & Commercial Subject Combinations – Cover Your JAMB Syllabus in 30 Days Challenge; https://dtwtutorials.com/jamb-2025-syllabus-in-30-days-timetable-challenge-by-dtw-tutorials-cover-your-jamb-syllabus-in-30-days-challenge/

– How to Manage Your Jamb Exam Time for High Scores; https://youtu.be/Tp4Va8haib8

– Physics Notes and Questions on All topics; https://dtwtutorials.com/category/tutorials/physics-tutorials/

– Chemistry Notes and Questions on All topics; https://dtwtutorials.com/category/tutorials/chemistry/

– How to Read, Understand and Remember Always- https://youtu.be/kL8BpRePudA

– How to Cover Your JAMB Syllabus Fast in 30 Days!!; https://youtu.be/RVgyn01Ptd0

– What to do a night before your Jamb Exam (+Exam Prayers); https://youtu.be/njbAx4Oz5Rw

– How to Manage Your Jamb Exam Time for High Scores; https://youtu.be/Tp4Va8haib8

– Overcoming Exam Fear/Anxiety– https://youtu.be/Uvf81rvd0ls

You can also join our online groups below for instant JAMB 2025 Updates;

Join DTW JAMB 2025 Intensive Tutorials Study Groups on Facebook, Telegram and WhatsApp Group;

Facebook Group – https://web.facebook.com/groups/dtwtutorialsgroup/

WhatsApp Group – https://chat.whatsapp.com/E8pprCQYtahKfpQN9UB0aU

Telegram Group – https://t.me/+AcXfhJPSIiI2ZTY0

WhatsApp Channel – https://whatsapp.com/channel/0029VaAWvTmDDmFT9o25dV3u

DTW JAMB 2025 Intensive Online Lessons/Tutorials

Online JAMB 2025 Tutorials – Your Path to Jamb Success!

Are you preparing for the JAMB 2025 Exam and aiming for excellence? Look no further than Online Jamb Tutorial by DTW Consult. We’re dedicated to helping you ace your Jamb with confidence.

- Why Choose DTW Online JAMB Intensive Tutorials?

• Engaging, Clear and Interactive Online Lectures

• Completion of JAMB Syllabus

• Weekly Quiz Assessments

• Continuous Brainstorming and Competitions

• Membership in an Active Learning Community

• Consistent Solving of JAMB Past Questions-

• Expert Jamb Instructors

• Comprehensive Study Materials - All Classes are Recorded!! In case you miss any class, and when you join us you will have access to all the previous class recorded videos!!!

• Subjects;

English

Physics

Chemistry

Biology

Math

Economics

Literature

Crs

Government

• Affordable Tuition – N7000 monthly (6pm – 10pm, Mon to Fri)

Lectures Ongoing! Register Now!!

Bank Details:

Account Name: DTW Consult

Account Number: 6414330770

Bank: Moniepoint

Amount – N7000

For easy payment and enrollment.

Proof of payment should be sent by WhatsApp.

Contact Us:

WhatsApp: 09085099582, 08038732879

Email: dtwconsultng@gmail.com

Take a step closer to your Jamb success with DTW Online Jamb 2025 Intensive Tutorials.

Let’s work together to unlock your full potential!

https://youtu.be/P7wtBH46ZMMnsive Tutorials. Let’s work together to unlock your full potential! #JambPrep #OnlineTutorial #DTWConsult #JambSuccess #jamb2025 #utme2025

No Comments